- There is not a lot of deliverable refined sugar available for the coming March’21 futures expiry.

- We think at least one trade house is therefore squeezing shorts ahead of the expiry.

- This means that the H/K spread has been strengthening, giving the wider sugar market a more positive feeling.

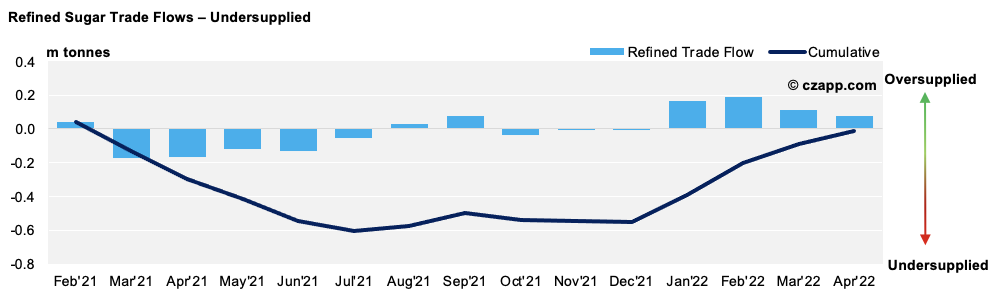

The refined sugar market is undersupplied

- The shortfall in supply follows poor crops in Thailand and the EU, the world’s two dominant low-cost refined sugar origins.

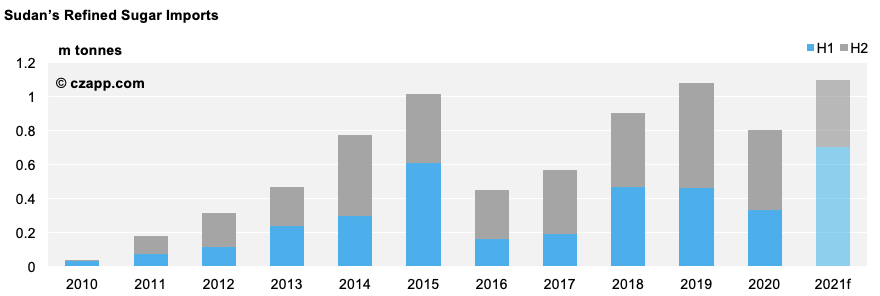

- The tightness is concentrated in the near term in part because spot refined sugar demand from Sudan has been very good; we think they could take up to 700k tonnes of refined sugar in H1’21.

- On top of this, container shipments around the world are still being disrupted by the knock-on effects of COVID lockdowns in 2020: container shortages and delays remain problematic in many ports.

- Refined sugar origins who have access to containers are therefore being incentivised to ship by strong physical values, further reducing deliverable breakbulk supply for the expiry.

- This is the case in Thailand, where containerised refined premiums are $50 over the futures; who would give up this kind of return to deliver against the futures expiry?!

Who could deliver?

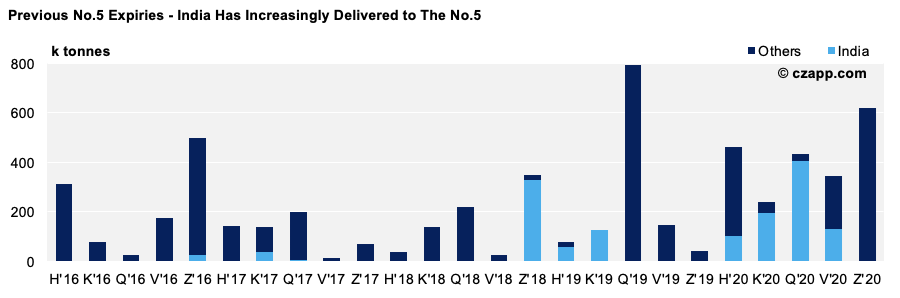

- We think the expiry will be dominated by Indian breakbulk supply.

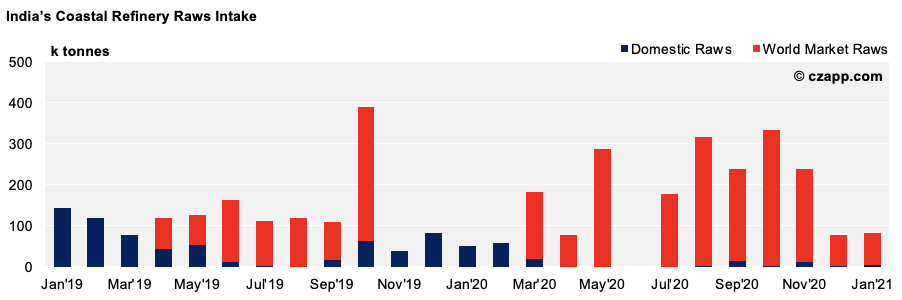

- Indian ports have been heavily affected by congestion caused by a shortage of available containers.

- This has reduced the refiners’ ability to ship refined sugar.

- As we’ve seen in the past, its coastal refiners are happy to use the No.5 to drive their export flow; delivery is a way of ensuring there’s a buyer for their sugar.

- As No.5 deliveries are for breakbulk shipment, delivering may help reduce the impact of the container shortage.

- The coastal refineries’ raw sugar offtake has been strong, so they should be able to supply a large volume, perhaps around 200k tonnes.

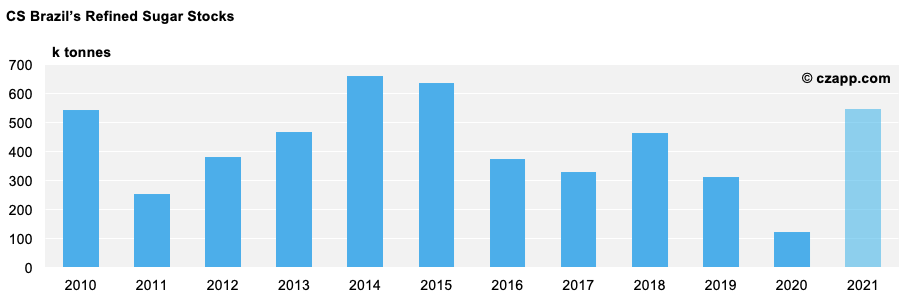

- CS Brazil’s February refined sugar stocks are the highest they have been for five years.

- Therefore, if the H/K spread stays strong, we think some CS Brazilian sugar could be delivered.

- It’s unlikely NNE Brazil will deliver, however, as its refined stocks are low due to strong offtake this season.

- This is also the case in Central America; most refined sugar from the region has already been committed.

- Guatemala delivered most of its refined against the Dec’20 contract (234k tonnes or 4,610 lots).

- If the receivers want more sugar than India or CS Brazil can commit, we could see volume delivered from toll refiners such as Dubai or Algeria.

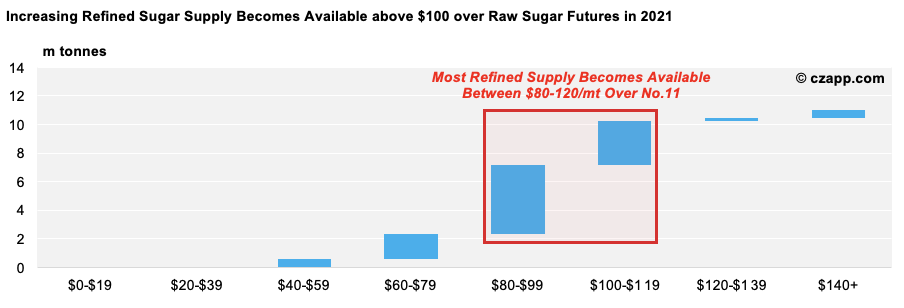

- However, refined prices would have to encourage these refiners to give up containerised shipments that are currently offering large premiums.

- In this case, the H/K spread and the white premium would need to strengthen further before the contract expires.

Receivers – short squeeze

- We think that one or more trade house may be looking to squeeze futures shorts.

- Much of the trade are now bullish and there could be receiver(s) for more than 500k tonnes.

- This tonnage could be against strong regional sales into the Indian Ocean region.

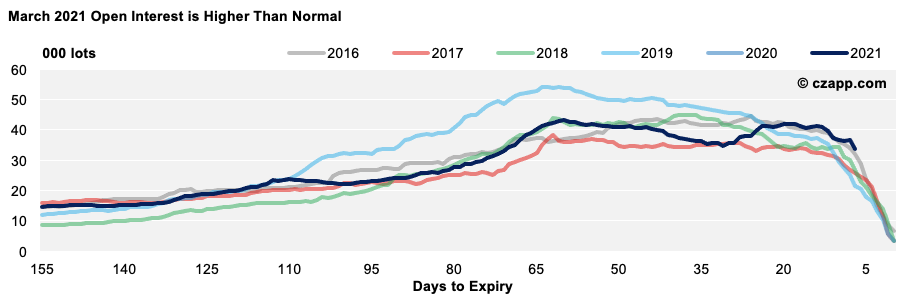

- Open interest remains higher than it has been previous years, meaning there’s plenty of contracts still left to roll.

- After expiry we think that the current stress on the refined market will start to ease.

- Most of the Sudanese offtake will have been shipped, and we hope the container problems will start to reduce.

- However, until the next Thai and EU crops get underway at the end of 2021, refined supply options will remain limited.

For more market analysis data like this and our marketplace visit czapp.com. You can sign up for free to access similar reports.